Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

The Ultrasound Tech Outlook 2024 report offers an analysis of the sector and highlights emerging trends, technological advancement, and market dynamics. It focuses on the integration of AI, enhanced portability, and expanded applications beyond traditional medical fields. As the industry evolves, this ultrasound report examines how these innovations shape patient care and broaden the utility of ultrasound solutions in various sectors. It discusses the challenges and opportunities that manufacturers, healthcare providers, and technology developers face as they navigate this sector.

This ultrasound tech outlook serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Ultrasound Tech Outlook 2024

- Executive Summary

- Introduction to the Ultrasound Tech Report 2024

- What data is used in this Ultrasound Tech Report?

- Snapshot of the Global Ultrasound Technology Industry

- Funding Landscape in the Ultrasound Technology Industry

- Who is Investing in Ultrasound Technology?

- Emerging Trends in the Ultrasound Technology Industry

- 5 Ultrasound Technology Startups Impacting the Industry

Executive Summary: Ultrasound Tech Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 680+ ultrasound technology startups developing innovative solutions to present five examples from emerging ultrasound technology industry trends.

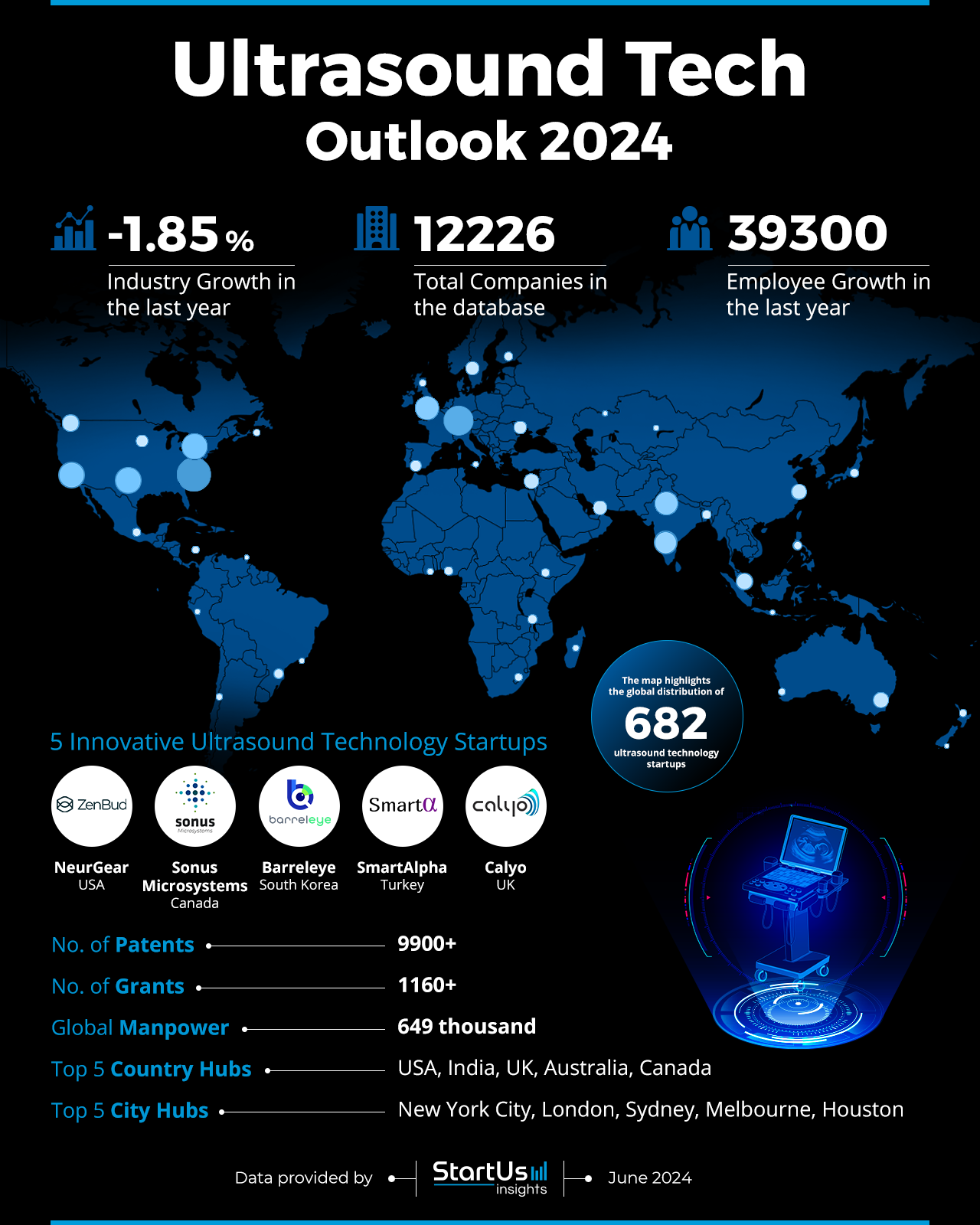

- Industry Growth Overview: The ultrasound technology sector experiences growth with over 12230 companies and 682 startups. However, it sees a slight decline in annual industry growth of -1.85%.

- Manpower & Employment Growth: The sector employs approximately 649000 individuals globally, with employee growth adding 39300 new jobs in the past year.

- Patents & Grants: The industry filed over 9900 patents and received more than 1160 grants to support research and development activities.

- Global Footprint: The sector is heavily represented in the USA, India, the UK, Australia, and Canada, with major city hubs in New York City, London, Sydney, Melbourne, and Houston.

- Investment Landscape: The industry showcases financial activity with an average investment value of USD 16.5 million per funding round, over 2080 funding rounds closed, and more than 980 companies receiving investments.

- Top Investors: Major investors include the European Innovation Council, Venture Investors, and Monash IVF. Top investors infused capital exceeding USD 162.8 million.

- Startup Ecosystem: Five innovative startup features include NeurGear (vagus nerve stimulation technology), Sonus Microsystems (polymer MEMS technology), Barreleye (biomechanical analysis), SmartAlpha (AI-on-ultrasound), and Calyo (autonomous mobility sensor).

- Recommendations for Stakeholders: The focus of the stakeholders should be on leveraging AI integration and enhancing portability to meet evolving market demands. There is a significant opportunity to expand ultrasound applications beyond traditional medical fields, such as industrial automation and personal healthcare devices. Fostering partnerships with technology leaders in AI and machine learning will enhance diagnostic accuracy and expand clinical and industrial applications in ultrasound.

Explore the Data-driven Ultrasound Market Report for 2024

The Ultrasound Technology Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s growth and innovation. The market includes over 12230 companies and 682 startups that offer a view of the sector’s infrastructure and dynamics. Despite a slight decline in industry growth of -1.85% over the last year, the industry is seeing broader adoption with new applications.

Over 9900 technologies in this industry registered for patents to reflect its growth in technological advancement. With 1160 grants awarded, the sector secured support underpinning ongoing research and development initiatives. Moreover, the industry employs 649K individuals globally. Also, it experienced employee growth and added 39300 new jobs in the last year indicating expansion and recruitment efforts.

Further, the heatmap highlights the USA, India, the UK, Australia, and Canada as the top country hubs. These regions demonstrate where the industry’s key activities and investments concentrate. At the city level, New York City, London, Sydney, Melbourne, and Houston emerge as the top nodes for industry operations and strategic developments.

What data is used to create this ultrasound outlook?

Based on the data provided by our Discovery Platform, we observe that the ultrasound technology industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The ultrasound outlook demonstrated visibility in media with over 6330 publications in the past year.

- Funding Rounds: It secured a notable position in financing, evidenced by data on more than 2080 funding rounds.

- Manpower: In terms of manpower, the industry employs over 649K workers globally, with more than 39.3 thousand new employees added last year alone.

- Patents: Over 9900 technologies in this segment filed for patents.

- Grants: It also received institutional support by receiving more than 1160 grants.

- Yearly Global Search Growth: The industry witnessed a 12.87% increase in global search interest over the last year to highlight its growing relevance and public interest.

- and more. Book a demo to explore all data points used to create this ultrasound technology report.

A Snapshot of the Global Ultrasound Market Outlook

This ultrasound market outlook offers a detailed snapshot of the industry’s current landscape, based on a dataset showcasing growth, investment, and manpower statistics. The industry currently employs about 649K individuals across various capacities. Over the past year, the industry experienced growth and added 39.3 thousand new jobs. This trend highlights an expanding sector and is also actively driving job creation.

Besides, with over 12230 companies operating within the industry, it sees a diverse ecosystem of enterprises ranging from startups to established firms. This base of companies contributes to a competitive and innovative market environment.

Explore the Funding Landscape of the Ultrasound Technology Industry

The financial activity within the industry has been strong. The average investment value per funding round stands at USD 16.5 million and indicates the infusion of capital into viable and growth-oriented companies. More than 720 investors are involved in the area, which reflects the financial resources to nurture the sector’s development.

In addition, the closure of over 2080 funding rounds demonstrates active investor confidence and a market for new and expanding enterprises. More than 980 companies received investments, which aids in their individual growth and advances the industry with innovation and development.

Who is Investing in Ultrasound Technologies?

The ultrasound technology market witnessed financial commitment from its top investors, with a combined capital contribution exceeding USD 162.8 million. This investment underscores the interest and confidence in the sector’s growth and innovation potential.

- The European Innovation Council allocated USD 22.8 million across 5 companies.

- Venture Investors contributed USD 54 million, spread over 4 companies.

- Monash IVF funded 4 companies with an investment of USD 8 million.

- Sofinnova Partners disbursed USD 48.9 million to 4 companies.

- Medica allocated USD 16.8 million to 3 companies.

- Foresight Group injected USD 10.7 million into 3 companies.

- Seneca Partners deployed USD 1.6 million into 2 companies.

- and more. Book a demo to explore all investment data in the ultrasound technology industry.

Access Top Ultrasound Innovations & Trends with the Discovery Platform

The image analysis trend area currently encompasses 1779 companies and employs approximately 74000 individuals. It experienced an increase, with an annual trend growth rate of 11.58%. This signals the market demand for image processing technologies, particularly in healthcare diagnostics and automated systems.

The mobile imaging trend emerged as an expanding field, represented by 364 companies. It employed around 31000 people. It experienced an annual growth rate of 4.18%. This trend is driven by the increasing need for portable diagnostic solutions and the integration of imaging technology into mobile devices for point-of-care services.

Teleradiology identifies 640 companies within its segment and employs nearly 59900 employees. This sector saw a consistent rise, with a growth rate of 5.55% annually, and added around 4400 new employees over the last year. It highlights the trend’s role in providing remote diagnostic services, especially vital in regions lacking specialized medical personnel.

5 Top Examples from 680+ Innovative Ultrasound Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

NeurGear develops Vagus Nerve Stimulation Device

US-based startup NeurGear develops a non-invasive ultrasound stimulation technology device, ZenBud. The device uses targeted ultrasound frequencies that stimulate the vagus nerve. This stimulation activates the nerve and promotes a natural relaxation response in the body. It focuses on this nerve and ensures that other neural pathways remain unaffected. ZenBud’s approach leverages the body’s own mechanisms to decrease stress hormone levels and increase neurotransmitters associated with well-being. Thus, ZenBud works as a stress-reduction tool.

Sonus Microsystems creates Polymer MEMS Technology

Canadian startup Sonus Microsystems develops customizable ultrasound transducers through polymer microelectromechanical systems (MEMS) technology. The startup builds the transducers using polymer-based capacitive micromachined ultrasound transducers (PolyCMUT) cells to resonate at ultrasonic frequencies and enhance applications from healthcare to wearables. In addition, advanced photolithography techniques create layered polymers and metals to form membranes that offer versatility and performance. This fabrication distributes these cells across surfaces and optimizes the transducers for non-destructive testing and personalized medical care by providing detailed, real-time imaging capabilities.

Barreleye conducts Breast, Liver & Cardiac Biomechanical Analysis

South Korean startup Barreleye develops AI-driven ultrasound diagnostic solutions, Int-BUS, Int-HUS, Vis-BUS, and Vis-CUS. Int-BUS diagnoses breast cancer by quantifying lesion characteristics and provides probabilistic assessments of malignancy through numerical analysis. Int-HUS contributes to liver health management by quantifying hepatic fat ratios. Vis-BUS streamlines the detection process in breast ultrasound imaging and automatically identifies and classifies suspicious lesions. Vis-CUS leverages AI to extract and visualize quantitative cardiac function data from echocardiographic images to enhance diagnostic workflows and provide detailed insights into myocardial health. These solutions enhance early disease detection and treatment planning in the breast, liver, and heart.

SmartAlpha offers AI-on-Ultrasound

Turkish startup SmartAlpha provides AI technology software that translates grayscale ultrasound images into anatomy-aware visuals in real-time. The technology includes a real-time Scan Success indicator that standardizes exam quality across different healthcare settings. It supports applications including anesthesia, orthopedics, and emergency medicine for more accurate diagnoses.

Calyo designs Autonomous Mobility Sensor

UK-based startup Calyo develops ultra-low size, weight power & cost (SWaP-C) ultrasound sensor products, Calyo Pulse and Calyo Sensus. Calyo Pulse features a low-energy, high-performance hardware and software stack that enables high-resolution, lidar-like point clouds for precise imaging and navigation. Moreover, it is optimized with field programmable gate array (FPGA) electronics for low operational costs and high efficiency. Calyo Sensus offers high-performance, GPU-accelerated sensor data processing to enable real-time, detailed visualization of surroundings. This SDK supports platform integrations, including robotics and autonomous driving systems, to enhance perception and object detection capabilities.

Looking for Comprehensive Insights into Ultrasound Industry Trends, Startups, or Technologies?

The Ultrasound Tech Outlook 2024 report suggests the future of ultrasound technology will grow with broader applications and reach. This report underscores the role of ultrasound solutions in improving healthcare outcomes and operational efficiency across industrial applications. Looking forward, stakeholders are encouraged to consider these technological developments and ensure they remain competitive to meet the demands of tomorrow. Book a platform demo to explore all 680+ startups and scaleups, as well as all industry trends impacting numerous industries globally.