The 2025 Utilities Sector Outlook provides an analysis of the industry that is undergoing transformations driven by technological advancements and an increasing focus on sustainability. The report explores key trends, innovations, and challenges that shape the utility industry. From digital twin technology to smart utilities and advanced analytics, utility companies are adapting to meet the needs of an increasingly interconnected and environmentally conscious world. The report also presents firmographic data and investment patterns driving the sector forward.

The report was last updated on January, 2025.

This utility report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Utilities Sector Outlook 2025

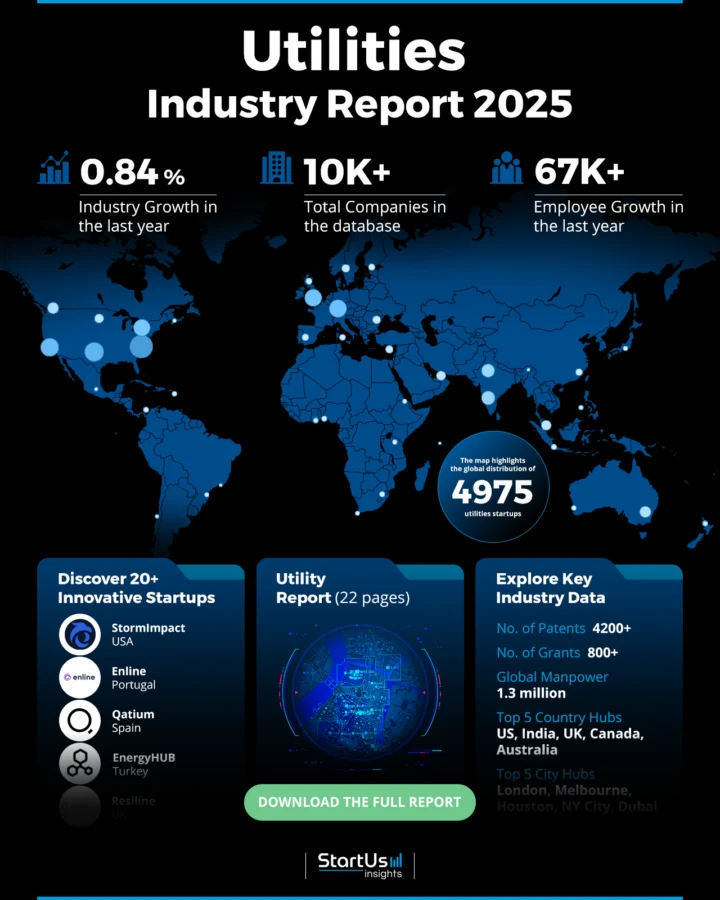

- Industry Growth Overview: The utilities industry is experiencing steady growth of 0.84%. It comprises over 4900 startups and more than 10 000 companies. The global utilities market is projected to reach USD 7305.9 billion in 2025, at a compound annual growth rate (CAGR) of 6.4%.

- Manpower & Employment Growth: Globally, the industry employs over 1.3 million workers. It has seen a growth of 67 000+ employees in the last year.

- Patents & Grants: It has secured over 4200 patents and more than 800 grants. The yearly patent growth rate stands at 2.59%, highlighting ongoing research and development efforts.

- Global Footprint: Key country hubs include the USA, India, the UK, Canada, and Australia. Major city hubs like London, Melbourne, Houston, New York City, and Dubai are key centers of startup activity and innovation. However, North America dominated the utilities market in 2024.

- Investment Landscape: The average investment value per round in the utilities industry is USD 100.7 million. There have been over 2700 funding rounds closed, involving more than 1000 investors and investments in over 900 companies.

- Top Investors: Investors such as BlackRock, Insight Partners, Energy Impact Partners, and more have collectively invested over USD 510 million.

- Startup Ecosystem: The utilities sector has a vibrant startup ecosystem with companies like StormImpact (Utility Grid Optimization), Enline (Digital Twin Technology), Qatium (Open Water Management Platform), EnergyHUB (Cloud-based Grid Monitoring), and Resiline (Pipeline Coating).

Methodology: How we created this Utility Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies, and market trends.

For this report, we focused on the evolution of the utility market over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the utility sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the utility market.

What data is used to create this utility industry report?

Based on the data provided by our Discovery Platform, we observe that the utility industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: With over 84 000 publications in the last year, the industry receives significant media coverage.

- Funding Rounds: Our database tracks data on more than 2700 funding rounds in this field.

- Manpower: The utilities sector employs over 1.3 million workers, with an addition of 67 000+ employees in the past year.

- Patents: The industry demonstrates its commitment to innovation through 4200+ patents.

- Grants: Securing over 800 grants underscores substantial backing for industry initiatives.

- Yearly Global Search Growth: Reflecting growing public and professional curiosity, the yearly global search growth for the utility industry stands at 3.64%.

Explore the Data-driven Utilities Outlook for 2025

The heatmap offers an overview of these metrics within the industry, highlighting trends and data points. Our database includes over 4900 startups and more than 10 000 total companies, reflecting the industry’s diverse landscape. The annual growth rate stands at 0.84%, which is an indication of steady progress.

The utility market is set to reach USD 9213 billion in 2029, growing at a CAGR of 6%. Additionally, various utilities’ capital expenditures are expected to reach USD 192 billion in 2025, up from USD 182 billion in 2024.

Credit: The Business Research Company

With over 4200 patents and 800 grants, innovation and research drive the industry forward. There are 1.3 million employees worldwide, with a growth of 67 000+ employees in the last year. The top country hubs—US, India, UK, Canada, and Australia—along with the top city hubs—London, Melbourne, Houston, New York City, and Dubai—represent key centers of activity and development. This heatmap provides insights into the utilities industry’s current state and future potential.

A Snapshot of the Global Utilities Industry

The utilities industry demonstrates steady and consistent expansion, with an annual growth rate of 0.84%. Within this landscape, over 4900 startups operate, and among them, more than 300 are early-stage startups. This is an indication of a strong pipeline of emerging companies. In addition, our database records over 700 mergers and acquisitions in the industry.

Data centers currently consume 6% to 8% of total annual electricity generation, expected to rise to 11% to 15% by 2030.

Patent activity within the utility industry is significant, with more than 4200 patents filed by over 3000 applicants. The industry has a yearly patent growth rate of 2.59%. Further, the United States leads as the top patent issuer, with over 1900 patents, followed by China with 600+ patents. This highlights the global nature of technological advancements in the sector.

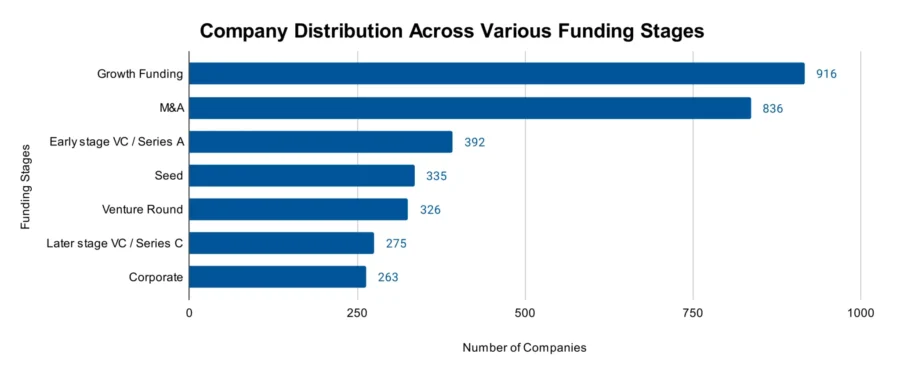

Explore the Funding Landscape of the Utilities Industry

Financially, the utility industry attracts substantial investment, with an average investment value per round of USD 100.7 million. The sector has closed more than 2700 funding rounds, involving over 1000 investors and resulting in investments in over 900 companies.

This level of financial activity underscores the confidence and interest of the investment community in the utilities sector’s growth and potential.

Who is Investing in Utilities sector?

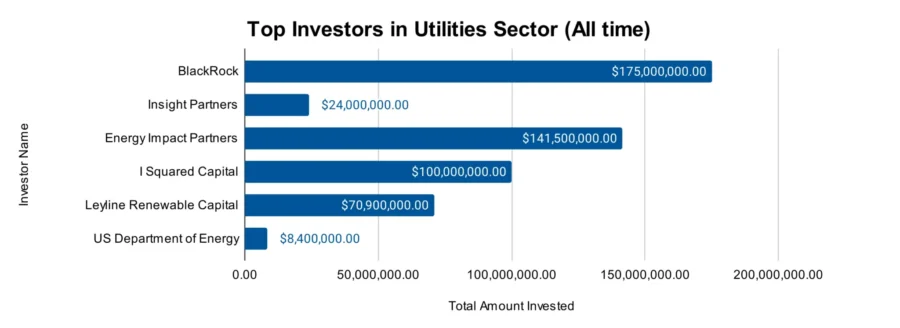

The utility industry has seen significant investment, with top investors contributing a combined value exceeding USD 510 million. Here’s a breakdown of the top investors in the utilities sector, along with their investment values and the number of companies they’ve invested in:

- BlackRock has invested USD 175 million across 3 companies. It has invested in several utility companies like National Grid PLC, NextEra Energy Inc, Enel SpA, and more.

- Insight Partners has contributed USD 24 million across 3 companies. It conducted a USD 20 million series C funding round for Prisma Photonics, which develops AI-driven technology for monitoring large scale power grids.

- Energy Impact Partners has allocated USD 141.5 million across 3 companies.

- I Squared Capital has invested USD 100 million across 3 companies. It signed an agreement to acquire a controlling interest in Aurora Utilities Limited with a commitment to invest USD 200 million.

- Leyline Renewable Capital has contributed USD 70.9 million across 3 companies. It provided a project development loan to RAI Energy for developing multiple large utility-scale solar and solar-plus storage projects.

- US Department of Energy has allocated USD 8.4 million across 3 companies.

Access Top Utilities Innovations & Trends with the Discovery Platform

Explore the emerging trends in the utility sector along with the firmographic insights:

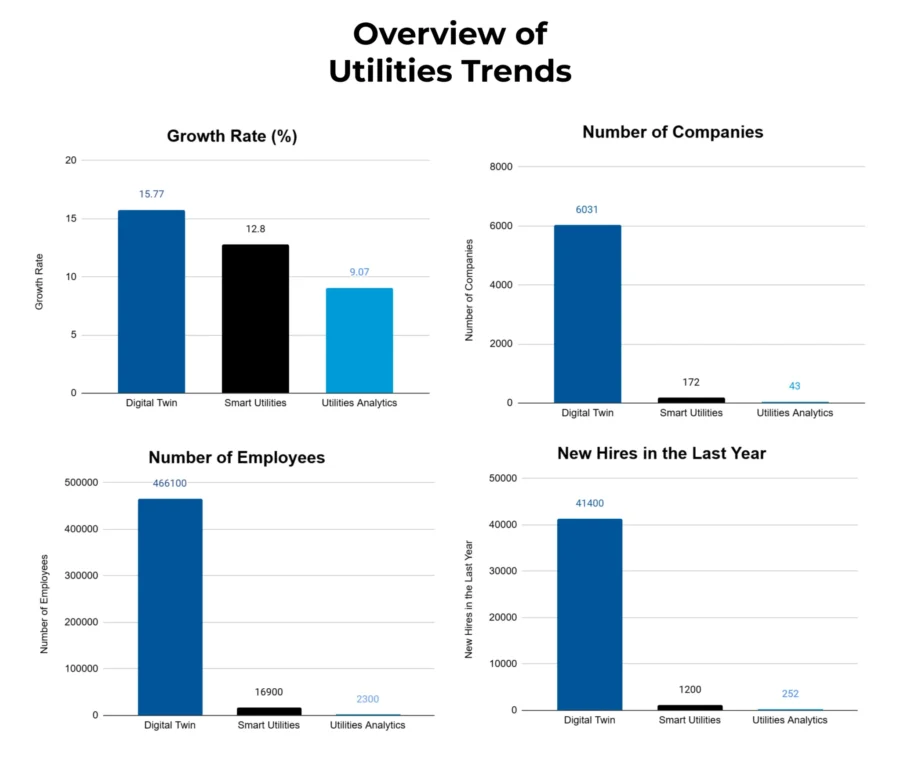

- Digital Twin is a trend in the utilities industry, with 6000+ companies participating. These companies employ 466 100 individuals, including 41 400 new employees in the last year. The annual trend growth rate for digital twins stands at 15.77%. This reflects the adoption and integration of digital replicas of physical assets and systems.

- Smart Utilities are an area of interest in the industry, characterized by the integration of advanced technologies to optimize utility services. Approximately 172 companies are actively involved, employing 16 900 individuals, with over 1200 new employees in the past year. The annual trend growth rate for smart utilities is 12.8%.

- Utilities Analytics is a growing trend with 43 companies identified in this domain. These companies employ more than 2300 individuals, with over 252 new employees added in the last year. The annual trend growth rate for utilities analytics is 9.07%, reflecting an increase in the adoption of data-driven decision-making processes.

5 Top Examples from 4900+ Innovative Utilities Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a platform demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

StormImpact facilitates Utility Grid Optimization

US-based startup StormImpact develops data-driven software that ensures the utility grid remains operational. Its prediction technology keeps utilities informed of climate changes and anticipates impacts.

The platform leverages historical data, predictive analytics, and machine learning to provide models for decision-making. StormImpact’s solutions include hurricane models that optimize crew placement for power restoration during storms.

The startup also offers vegetation management tools that maintain infrastructure to prevent wildfires.

Enline offers Digital Twin Technology

Portuguese startup Enline provides sensorless A.I.-driven digital twin technology and dynamic line rating for energy monitoring. Its product, EnLine LiveView provides real-time data, while Enline OptiMax minimizes energy losses.

Enline PredictPro offers AI to forecast issues for proactive maintenance, and Enline Safeguard mitigates wildfire and equipment failure risks. Lastly, Enline SmartDesign enables energy project planning using advanced simulations.

Enline’s solutions predict faults, optimize energy assets, and enhance overall infrastructure efficiency.

Qatium provides an Open Water Management Platform

Spanish startup Qatium builds a water management platform. Its network visualization feature provides actionable insights for decision-making. The system offers a model builder for creating hydraulic models from GIS data.

The platform also offers warnings for anomalies to identify and address network issues. The startup connects to live data through AMI/SCADA and enables real-time deviation detection. In addition, it offers a digital water assistant, Q, that assists with workload sharing and provides guidance.

EnergyHUB offers Cloud-based Grid Monitoring

EnergyHUB, a Turkish startup, provides GridGuardian, a cloud-based system for real-time grid monitoring. It leverages mapping tools and grid topology data to detect and notify about faults.

The startup’s dashboard displays and pinpoints grid events, while reporting and sensor management tools enhance operational efficiency. The instant SMS and email alerts feature provides actionable insights on fault type and location.

GridGuardian integrates with existing systems via standard interfaces and allows utilities to maintain grid reliability.

Resiline builds Pipe Line Coating

UK-based startup Resiline builds spray-in-place pipe (SIPP) lining materials. Using SIPP material is a cost-effective, trenchless way to address pipeline integrity issues, restore flow and pressure, decrease network leakage, and more.

The Resiline 320 is suitable for drinking water pipe applications and uses novel filler technology to reduce water absorption. It is made using polyurea, BPA, and VOC free, and minimizes shrinkage and risk of cracking.

The Resiline 330 is used for sewer and wastewater pipes. It is resistant to chemicals like hydrogen sulfide, sulphuric, and nitric acid. The product comes with a smooth low friction surface, abrasion resistance, and adhesion qualities. The pipeline coating material also reduces carbon footprint. It additionally ensures high creep strength, high tensile strength, high wet flexural modulus, and low water absorption.

Gain Comprehensive Insights into Utilities Trends, Startups, or Technologies

The utilities sector outlook shows an industry transforming due to technological innovation and an emphasis on sustainability. Emerging trends, including digital twin technology, smart utilities, and advanced analytics, are playing a key role in enhancing efficiency and resilience. Contact us to explore all 4900+ startups and scaleups, as well as all industry trends impacting utility companies worldwide.

![Dive into the Top 10 Water Management Trends & Innovations [2025]](https://www.startus-insights.com/wp-content/uploads/2025/04/Water-Management-Trends-SharedImg-StartUs-Insights-noresize-420x236.webp)