The Warehouse Market Report 2025 analyzes global warehousing trends, highlighting the impact of e-commerce growth and the adoption of automation, robotics, and analytics to enhance efficiency and supply chain management. It explores key areas like warehouse automation, reverse logistics, and risk management, alongside funding patterns, market players, and patent activity. The report offers stakeholders, investors, and policymakers insights into opportunities and challenges shaping the future of the warehousing industry.

This report was last updated in January 2025.

Executive Summary: Warehouse Market Report 2025

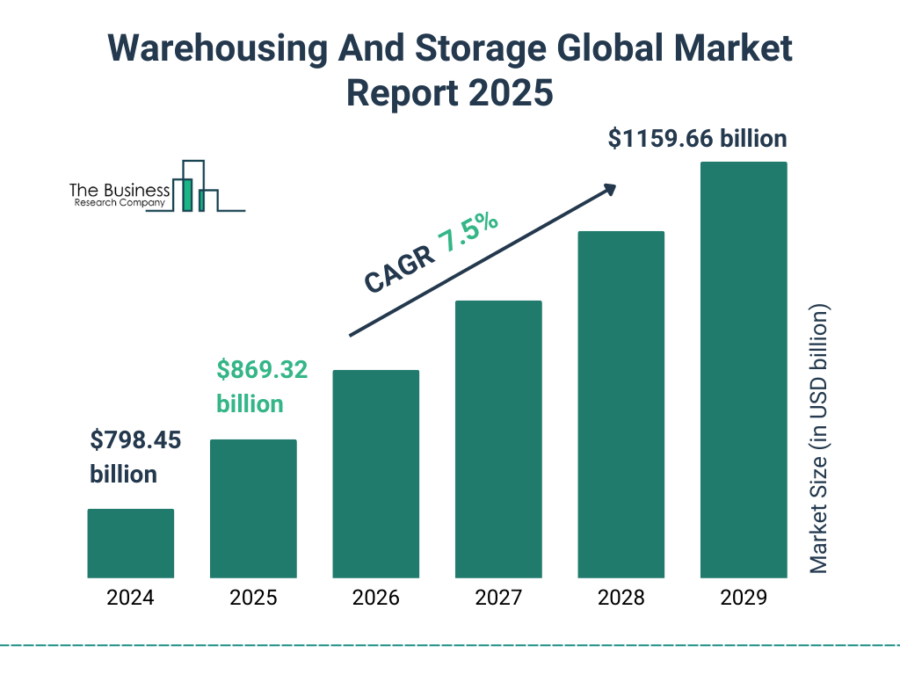

- Industry Growth Overview: The global warehousing and storage market size will grow from USD 869.32 billion in 2025 to USD 1159.66 billion in 2029 at a compound annual growth rate of 7.5%. On a micro level, the warehousing market experienced an annual growth rate of 4.78% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The industry employs over 7 million individuals, with an addition of 330K+ new employees in the last year.

- Patents & Grants: The market has secured over 137K patents and more than 1290 grants. The patent growth rate is 8.04% yearly, with the USA and China leading in patent issuance.

- Global Footprint: Key hubs include the USA, India, UK, Canada, and Australia, while major city hubs encompass Dubai, Sydney, Melbourne, Mumbai, and Singapore.

- Investment Landscape: The total funding closed exceeds 17300, with average investment values exceeding USD 32 million per round. More than 11K investors are actively involved.

- Top Investors: Notable investors, including Norilsk Nickel, Air Liquide, Interros, and more have collectively invested over USD 7.08 billion.

- Startup Ecosystem: Five innovative startups, Roboworks (palletizing robots), Zip24 (delivery management software), Skyware (IoT & AI-enabled storage systems), Sorair Technologies (security surveillance systems), and DRVBOT (autonomous mobile robots), showcase the market’s global reach and entrepreneurial spirit.

Methodology: How We Created This Warehouse Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of warehouses over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within warehouses

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the warehouse industry.

What Data is Used to Create This Warehousing Market Outlook?

Based on the data provided by our Discovery Platform, we observe that the warehousing industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: About 29K news and publications have been covered for warehousing, which reflects the industry’s strong media and academic coverage.

- Funding Rounds: Our database documents more than 17 300 funding rounds.

- Manpower: The workforce in the warehousing market exceeds 7 million workers, with the addition of over 330K new employees in the past year.

- Patents: The warehousing industry holds more than 137K patents.

- Grants: Over 1290 grants have been awarded to support various initiatives within the warehouse sector.

- Yearly Global Search Growth: The yearly global search growth for the warehouse market reached 3.66%. This demonstrates increasing interest from various stakeholders.

Explore the Data-driven Warehouse Market Report for 2025

According to The Business Research Company, the global warehousing and storage market size will grow from USD 869.32 billion in 2025 to USD 1159.66 billion in 2029 at a compound annual growth rate of 7.5%.

The warehouse racking market is expected to grow at a compound annual growth rate of 4.2%, reaching approximately USD 10.10 billion in 2025.

The warehousing industry outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

The database contains 4320+ startups which illustrate a vibrant entrepreneurial landscape. In total, this database features over 88 370 companies. Over the past year, the warehousing market experienced a growth rate of 4.78%.

Credit: The Business Research Company

Notably, the number of patents has surpassed 137K, which showcases innovation and intellectual property (IP) development.

Additionally, companies received 1290+ grants, and the global workforce in this sector exceeds 7 million.

Employee growth reached 330K in the last year and this emphasizes the industry’s increasing demand for talent.

Key hubs for this market include the USA, India, the UK, Canada, and Australia at the country level. At the city level, major hubs are Dubai, Sydney, Melbourne, Mumbai, and Singapore.

The U.S. warehouse market is expected to grow by 5.8% annually, driven by e-commerce and the need for last-mile delivery solutions.

Moreover, the Asia Pacific on-demand warehousing market size is projected to be worth around USD 193.54 billion by 2034.

A Snapshot of the Global Warehousing Industry

The warehousing industry outlook report 2025 reveals major insights into the sector’s performance and trends. The market experienced an annual growth rate of 4.78%, indicating steady progress.

The data shows a major entrepreneurial environment, with 4320+ startups actively participating in the market. Among these, over 2000 are in the early stages of development.

Additionally, the industry recorded more than 4300 mergers and acquisitions. Innovation remains a key focus, as evidenced by the presence of over 137K patents.

The warehouse market has more than 15K patent applicants and the yearly patent growth rate stands at 8.04%. The USA leads in patent issuance, accounting for over 53 900 patents, followed by China with approximately 33 900+ patents.

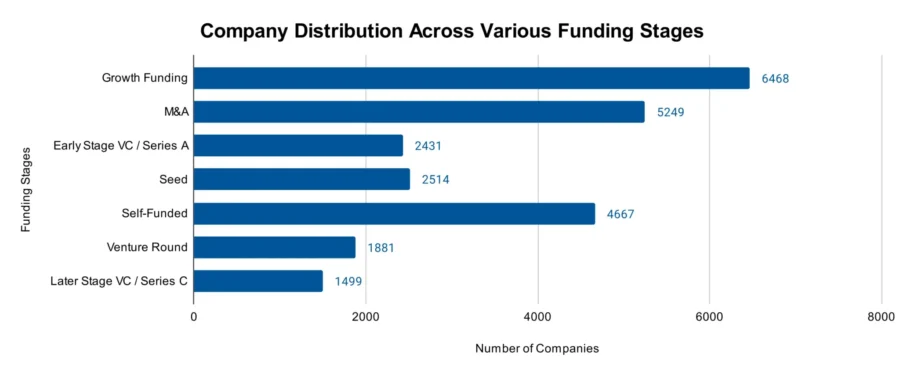

Explore the Funding Landscape of the Warehousing Industry

The average investment value per funding round stands at USD 32 million. The market has attracted over 11 000 investors. This demonstrates a strong interest in warehouse-related ventures.

In total, more than 17 300 funding rounds have closed which highlights the active engagement of investors in supporting business growth. Additionally, these funding efforts have impacted over 4830 companies.

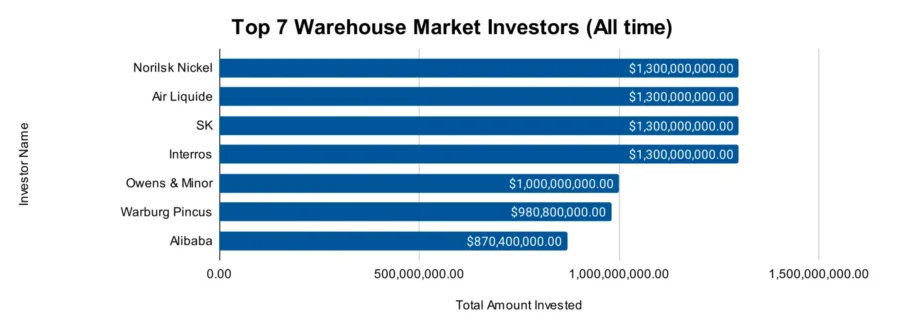

Who is Investing in the Warehousing Market?

The combined investment value of the top investors in the warehousing market exceeds USD 7.08 billion.

- Norilsk Nickel invested USD 1.3 billion in at least 1 company. Norilsk Nickel’s board approved a budget of approximately USD 2.1 billion for investments in 2025.

- Air Liquide provided USD 1.3 billion to at least 1 company. Air Liquide invested USD 1.74 billion in H1 2024, secured renewable energy contracts in South Africa, and expanded its biomethane production in the USA.

- SK contributed USD 1.3 billion to at least 1 company. SK Group emphasized its commitment to sustainability and aims to reduce carbon emissions by 200 million tons by 2030.

- Interros invested USD 1.3 billion in at least 1 company. Interos advanced its AI-powered supply chain risk platform, secured USD 40 million in funding, and launched Ask Interos for real-time supplier threat identification.

- Owens & Minor committed USD 1 billion to at least 1 company. Owens & Minor announced an agreement to acquire Rotech Healthcare Holdings for USD 1.36 billion.

- Warburg Pincus invested USD 980.8 million across 6 companies. Warburg Pincus partnered with Mashura, investing USD 300 million to drive growth and innovation.

- Alibaba offered USD 870.4 million to 7 companies. Alibaba Cloud partnered with Olympic Broadcasting Services to develop an AI-enhanced multi-camera replay service.

Top Warehouse Innovations & Trends

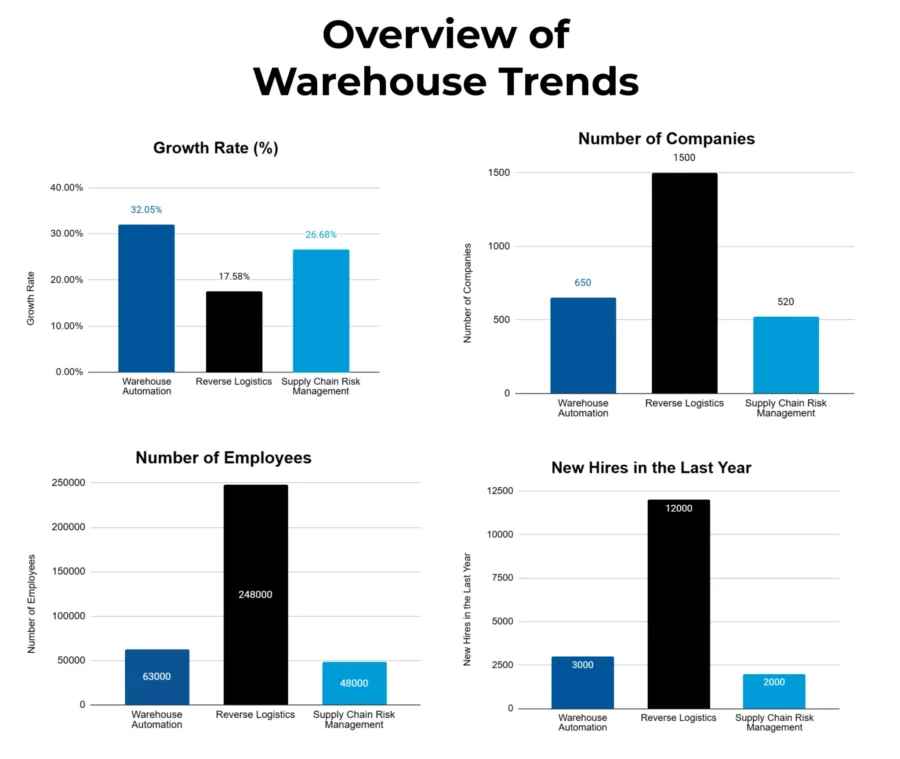

This section highlights the top three trends in the warehousing market, supported by firmographic data.

- The Warehouse Automation segment consists of over 650 total companies operating in this segment. There are more than 63K individuals employed, with 3K+ new employees added in the last year. The annual trend growth rate for warehouse automation stands at 32.05%. This indicates a rapid expansion driven by increased adoption of automation technologies to increase operational efficiency and address labor shortages.

- Reverse Logistics encompasses over 1500 total companies and this reflects a major industry presence. The domain employs more than 248K employees, with 12K+ new hires in the past year. The annual trend growth rate of 17.58% for reverse logistics demonstrates a major increase in demand for returns management and sustainable practices.

- The Supply Chain Risk Management domain comprises over 520 total companies and employs more than 48K individuals, with 2K+ new employees joining in the last year. The annual trend growth rate for this segment is 26.68%. This highlights the importance of risk mitigation strategies in warehousing for efficient inventory management and to minimize disruptions.

Moreover, the warehouse robotics market is projected to grow to USD 9.1 billion by 2025, with collaborative robots (cobots) playing a significant role in streamlining operations.

5 Top Examples from 4300+ Innovative Warehouse Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Roboworks offers Palletizing Robots

Roboworks is a Dutch startup that develops robotic solutions to automate warehousing operations.

Its product, the MultiStack automatically identifies, checks, sorts, and palletizes incoming cartons while applying stretch wrap and labels.

The startup also offers RoboStack, a mobile robotic palletizer, for handling mixed goods in high-volume inbound processes.

Additionally, Roboworks provides FlexConveyor, a flexible roller conveyor, that connects with RoboStack and enables efficient transport of cartons.

Zip24 provides Warehouse Management Software

Zip24 is a UAE-based startup that offers Storfox, a warehouse management software (WMS) to optimize inventory accuracy, streamline replenishment of fast-moving items, and manage operations across multiple warehouses.

Storfox is a cloud-based fulfillment engine for businesses to forecast orders, oversee logistic transactions, and handle routine warehouse processes. This software also allows retail operations, and order shipping fulfillment with real-time tracking.

It provides unmatched inventory visibility for order accuracy and faster fulfillment.

Further, Zip24 offers Shipox, a delivery management software (DMS) that simplifies logistics from pickup to delivery for real-time parcel tracking and end-to-end visibility.

Skyware develops IoT & AI-Enabled Storage Systems for Agri Warehousing

Skyware is an Indian startup that offers IoT and AI-enabled storage systems for agri warehouses. Its technology uses real-time data modeling to forecast spoilage and optimize the shelf life of harvested products.

By deploying IoT-based monitoring devices, Skyware tracks environmental conditions within storage spaces and applies AI-backed virtual assistants to automate maintenance and provide remote support.

Moreover, the technology enables spoilage prediction, real-time quality analysis, instant theft alerts, and worker management.

Sorair Technologies develops a Security Surveillance System

UK-based startup Sorair Technologies provides surveillance systems that use AI, robotics, and sensors to ensure security across warehousing.

The startup’s platform, Soranet, integrates existing CCTV cameras, drones, and sensors for continuous monitoring and automated responses to threats.

It detects incidents like intrusion or fire and automatically deploys drones for quick reconnaissance. Businesses gain control through a single interface and access remotely for customizable security configurations.

Soranet thus increases site security, reduces blind spots, and provides real-time alerts to safeguard stored inventory and protect high-value assets within warehousing operations.

DRVBOT specializes in Robotics System Control & Administration

DRVBOT is a Turkish startup that offers ORCA, its software that simplifies robotics system control and administration in warehouses.

The software enables operators to manage automated guided vehicles (AGVs), automated storage and retrieval systems (ASRS), and other warehouse machinery through a centralized interface.

It also is customizable and integrates with existing warehouse management systems (WMS) to improve efficiency, reduce cycle times, and increase worker productivity.

Gain Comprehensive Insights into Warehouse Trends, Startups, or Technologies

In 2025, the warehousing market will continue to grow, propelled by advances in warehouse automation, reverse logistics, and supply chain risk management. The integration of smart warehouse solutions will further support inventory management and faster order fulfillment while the focus on sustainability will continue through investments in energy-efficient systems and eco-friendly practices.

Get in touch to explore all 4300+ startups and scaleups, as well as all industry trends impacting warehousing companies.