The 2024 Waste Management Outlook presents an overview of an industry that covers various activities such as waste collection, transportation, recycling, and disposal. Given the increasing awareness about ecosystem degradation and resource depletion, developments in waste management technologies are becoming highly relevant. Firms in this sector build solutions like smart waste management systems, waste-to-energy technologies, and circular waste economy models. This report offers a detailed analysis of the waste management industry, examining market trends, regulatory frameworks, and key players.

This report was last updated in July 2024.

This waste management report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Waste Management Outlook 2024

- Executive Summary

- Introduction to the Waste Management Report 2024

- What data is used in this Waste Management Report?

- Snapshot of the Global Waste Management Industry

- Funding Landscape in the Waste Management Industry

- Who is Investing in Waste Management?

- Emerging Trends in the Waste Management Industry

- 6 Waste Management Startups Impacting the Industry

Executive Summary: Waste Management Industry Outlook 2024

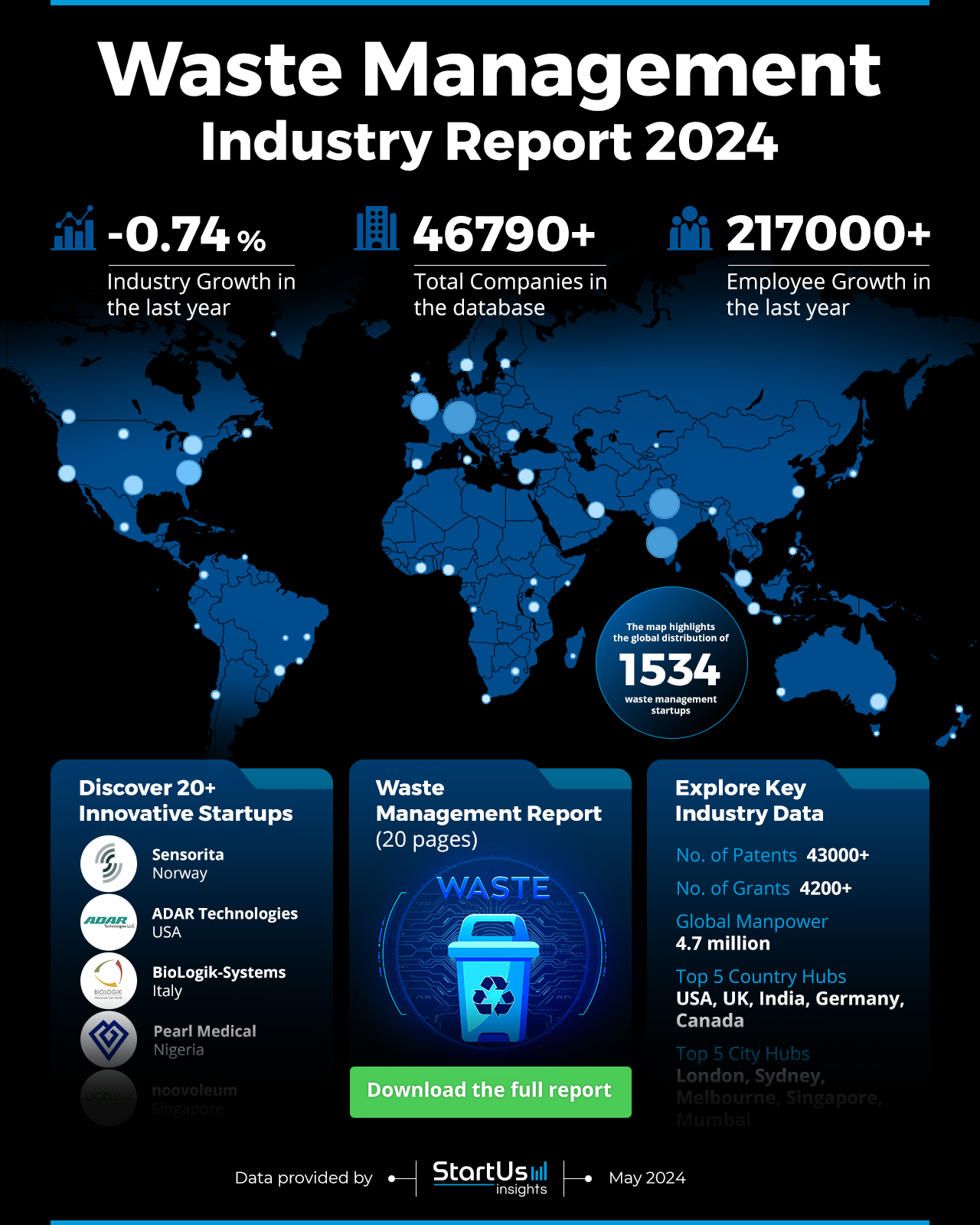

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1500+ waste management startups developing innovative solutions to present six examples from emerging waste management industry trends.

- Industry Growth Overview: The waste management market report indicates that the industry has seen an annual growth rate of -0.74% with the presence of more than 46790 companies worldwide

- Manpower & Employment Growth: The industry employs 4.7 million people, with an increase of 217000 employees in the previous year.

- Patents & Grants: The industry’s dedication to innovation and research is demonstrated by over 43000 patents and 4200 grants.

- Global Footprint: The sector is established in hubs like the US, UK, India, Germany, and Canada. Important city hubs are in London, Sydney, Melbourne, Singapore, and Mumbai.

- Investment Landscape: The industry has received substantial investment, with an average investment value of USD 44.6 million per round, backed by more than 3300 investors across 7600 funding rounds.

- Top Investors: Entities like the European Investment Bank, Oaktree Capital Management, and International Finance, among others, have invested a total exceeding USD 4 billion.

- Startup Ecosystem: Six startup features include Sensorita (Waste Level Measuring Sensor), ADAR Technologies (Drying, Pulverizing, and Sanitizing Solution), BioLogik-Systems (Biomass Electric Power Generation), Pearl Medical (Integrated Medical Waste Management), noovoleum (Used Cooking Oil Collection), and anessa (Anaerobic Digestion).

- Recommendations for Stakeholders: Investors are encouraged to support eco-friendly technologies, startups, and entrepreneurs creating scalable, zero-waste solutions. Companies are encouraged to adopt circular economy practices, enhance waste segregation, and improve recycling processes. Governments must establish wide-ranging policies and incentives for promoting sustainable practices across industries and society.

Explore the Data-driven Waste Management Outlook for 2024

The Waste Management Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap presents an analysis of our database, which includes 1534 startups and more than 46790 companies. Even though the industry growth saw a slight decline of 0.74% last year, there is still a strong presence of innovation, evidenced by over 43000 patents and 4200 grants.

The global workforce totals 4.7 million employees, showing a growth of 217000 employees in the last year. Top country hubs are in the US, UK, India, Germany, and Canada, with London, Sydney, Melbourne, Singapore, and Mumbai emerging as top city hubs. The above heatmap provides a view into the evolving landscape of the waste management industry.

What data is used to create this waste management industry report?

Based on the data provided by our Discovery Platform, we observe that the waste management industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry has been the subject of numerous news coverage and publications, with a total of over 11600 publications in the last year.

- Funding Rounds: Our database contains data from more than 7600 funding rounds, suggesting a healthy level of financial support.

- Manpower: The industry employs over 4 million workers, with more than 217000 new employees added in the past year.

- Patents: The sector has over 43000 patents, demonstrating its dedication to innovation and technological progress.

- Grants: The industry has been awarded more than 4200 grants, indicating solid research and development backing.

- Yearly Global Search Growth: The yearly global search growth for the industry was 10.43%, indicating a rise in public interest and awareness.

A Snapshot of the Global Waste Management Industry

The waste management industry shows growth and investment, which reflects its role in addressing global environmental challenges. The industry employs a workforce of 4.7 million people, with a growth of 217000 employees in the last year. This growth indicates the increasing demand and importance of waste management services globally. Further, the industry includes over 46790 companies, showing its broad and diverse nature.

Explore the Funding Landscape of the Waste Management Industry

Coming to the investment in this sector, the average investment value per round is USD 44.6 million. This investment is backed by more than 3300 investors, who have collectively closed over 7600 funding rounds. The financial support is widespread, with over 3400 companies receiving investments, suggesting investor confidence in the industry’s potential and future growth.

Who is Investing in Waste Management?

The waste management industry has received considerable investment, with investors collectively investing more than USD 4 billion. Here are the investors and their respective contributions:

- European Investment Bank has invested USD 781.7 million in 7 companies, showing confidence in waste management innovation and infrastructure.

- Oaktree Capital Management has committed USD 462.5 million to 5 companies, focusing on strategic investments in growth and efficiency.

- International Finance Corporation has supported 8 companies with a total investment of USD 333.8 million, indicating its focus on global waste management solutions.

- DST Global has invested USD 324 million in 2 companies, showing targeted, high-value investments.

- Crédit Agricole has invested USD 286.5 million across 5 companies, demonstrating a commitment to sustainable finance.

- Montagu Private Equity has invested USD 238 million in 3 companies, showing its dedication to industry growth.

- One Equity Partners has allocated USD 225 million to 3 companies, highlighting strategic investments in the sector.

Access Top Waste Management Innovations & Trends with the Discovery Platform

Explore the growing waste management trends along with the firmographic data:

- Sustainable Waste Management is a key trend, with 1063 companies actively working in this sector. These companies employ 101100 individuals, showing the manpower dedicated to sustainability efforts. In the last year, 5600 new employees joined the workforce, indicating the sector’s growth and demand for expertise. The annual trend growth rate of 5.81% suggests an increasing emphasis on sustainable practices and technologies.

- Medical Waste Management is an important trend with 584 companies focused on safely handling and disposing hazardous medical waste. These companies employ 95400 workers globally, including 4600 new employees added in the past year, showing ongoing demand for skilled professionals in this field. Despite the importance of this trend, it has experienced an annual trend growth rate decline of 1.08%.

- Waste Analytics is a growing niche, with 37 companies specializing in data-driven waste management solutions. These companies employ 765 people, including 235 new employees added in the last year, suggesting growth and increasing interest in analytics-driven approaches. The sector has an annual trend growth rate of 25.07%, indicating the rising importance of leveraging data to optimize waste management processes.

6 Top Examples from 1500+ Innovative Waste Management Startups

The six innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Sensorita develops Waste Level Measuring Sensor

Norwegian startup Sensorita builds sensor technology to streamline waste management. It uses sensors to measure fill levels in large waste containers. Then, it analyzes and contextualizes the collected information in the cloud to provide a full overview of container capacity and location. The system predicts when a container is due for pick-up, based on AI and historical data. Sensorita enables waste companies to automate and streamline their operations and promotes sustainability.

ADAR Technologies offers Drying, Pulverizing, and Sanitizing Solution

US-based startup ADAR Technologies provides a technology that transforms waste into valuable products to promote a circular economy. Its technology mechanically extracts moisture from waste, requiring less energy than traditional methods. This process uses electricity and eliminates the need for chemicals, fossil fuels, and carbon emissions. The outputs are nutrient-rich food powders, livestock feed, biofertilizers, and more. Through its drying, pulverizing, and sanitizing solution, ADAR Technologies promotes sustainable waste management.

BioLogik-Systems facilitates Biomass Electric Power Generation

Italian startup BioLogik-Systems develops BioHeat System that transforms waste into a high-quality secondary resource. This process generates renewable energy and nutrient-rich organic compost. The startup offers BioPro, which is used as a source for local heating and cooling systems. BioStandard is for decentralized distribution in rural areas, whereas BioAutarky is for total energy self-sufficiency. These products cater to various sectors including agriculture, wood production, food and beverage industry, and municipal composting plants.

Pearl Medical enables Integrated Medical Waste Management

Nigerian startup Pearl Medical transforms healthcare waste management. Its product, Pearl Medical Incinerator, ensures safe and responsible waste disposal. In addition, the Pearl Medical App allows seamless management of medical waste, tracking waste generation, monitoring compliance, and streamlining reporting. The startup also offers Pearl Shredder, which breaks down medical waste with ease. This shredder handles a wide range of waste materials and maximizes utility in healthcare facilities.

noovoleum collects Used Cooking Oil (UCO)

Singaporean startup noovoleum develops a mobile application and collection box to optimize the collection of used cooking oil. This process involves households and small producers, who receive incentives through profit sharing. The collected oil undergoes recycling, thus promoting a circular economy. noovoleum’s approach to waste management supports eco-friendly practices and contributes to a sustainable future

anessa develops Anaerobic Digestion Solutions

Canadian startup anessa offers solutions for waste management, focusing on turning waste into value. Its platform, AD.A, provides feasibility analysis for anaerobic digestion. Another platform, AD.O, optimizes feedstock for maximum biogas production. Whereas, AD.M, offers dynamic monitoring of anaerobic digestion processes. These platforms aid in evaluating the use of digestate as a high-grade fertilizer. They also reduce operational costs by producing renewable energy and contributing to the circular economy.

Gain Comprehensive Insights into Waste Management Trends, Startups, or Technologies

The waste management industry is set for ongoing growth and innovation, influenced by developments in sustainability, data analytics, and more. Current trends show a focus on environmentally friendly practices, enhanced efficiency, and increasing regulatory compliance. Contact us to explore all 1500+ startups and scaleups, as well as all industry trends impacting waste management companies.