The 2025 Wealth Management Industry Report explores how technology, shifting client expectations, and regulations are transforming the sector. Key trends include AI-driven portfolio optimization, the rise of robo-advisors, and growing demand for ESG investing. The report profiles leading firms, fintech disruptors, market trends, and technologies, offering insights into the evolving financial advisory landscape.

Executive Summary: Wealth Management Industry Outlook 2025

- Industry Growth Overview: The wealth management industry grew at an annual rate of 13.19%, with over 16000 companies and 1100+ startups contributing to its dynamic ecosystem. The wealth management platform market is also expanding rapidly, expected to grow from USD 5.84 billion in 2024 to USD 15.32 billion by 2031, at a CAGR of 14.8%

- Manpower & Employment Growth: The industry employs more than 1.1 million workers globally. It added over 58000 new employees last year, which indicates workforce expansion.

- Patents & Grants: Over 40 patents and 350 grants highlight the industry’s commitment to innovation, with a yearly patent growth rate of 5.7%, led by the USA and China.

- Global Footprint: Key country hubs include the United States, the United Kingdom, India, Australia, and Canada. Leading city hubs are London, New York City, Sydney, Mumbai, and Singapore.

- Investment Landscape: Over 3900 funding rounds were closed by more than 3000 investors, with an average funding of USD 76.4 million per round, showing strong financial backing.

- Top Investors: Leading investors include Advent International, JP Morgan, IGM Financial, and more who have contributed to the USD 5 billion combined investment value.

- Startup Ecosystem: Notable startups include Figg (AI-driven wealth management), Insaaph Capital (on-chain split-crypto index), Kredit (automated credit improvement advisory), Linconomy (digital wealth management), and Flanks (open wealth aggregation).

What data is used to create this wealth management report?

Based on the data provided by our Discovery Platform, we observe that the wealth management industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the industry’s short-term future direction.

- News Coverage & Publications: The industry received significant attention with over 36 000 publications last year. It highlights its importance in media and research.

- Funding Rounds: The funding activity remains strong, with more than 3900 funding rounds in our database.

- Manpower: The global workforce exceeds 1.1 million, with over 58 000 new employees added last year. This is an indication of steady manpower expansion.

- Patents: Innovation efforts are clear with the issuance of more than 40 patents, which contributes to advancements in the field.

- Grants: The sector has also secured over 350 grants that support its developmental initiatives.

- Yearly Global Search Growth: The global interest continues to rise, with a 14.23% yearly increase in global search growth for wealth management topics.

Methodology: How We Created This Wealth Management Industry Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of automation software over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within wealth management

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the wealth management market.

Explore the Data-driven Wealth Management Outlook for 2025

Did you know the wealth management industry is on the brink of a massive shift? By 2045, the wealth transferred will reach USD 84 trillion – estimating USD 72.6 trillion will be transferred to heirs while USD 11.9 trillion will be donated to charities.

The Wealth Management Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap highlights key metrics in the wealth management industry, showing growth trends, workforce distribution, and geographic concentration. The industry includes over 16 000 companies and 1100 startups, recorded in our database which reflects its dynamic and expanding ecosystem.

Market projections underline this growth trajectory. According to a report by Zion Market Research, the market is projected to grow at a slightly higher CAGR of 11% from 2023 to 2030, reaching USD 3.48 trillion by the end of the forecast period.

Annual industry growth reached 13.19%, with global manpower surpassing 1.1 million employees and 58000 new jobs added last year. Innovation is evident with over 40 patents and 350 grants contributing to advancements.

As per Allied Market Research, North America dominates the market, accounting for more than half of the global revenue as of 2020, with expectations to maintain its lead through 2030. The Asia-Pacific region, however, is projected to experience the fastest growth, with a CAGR of 12.7% during the forecast period

Insights from the Discovery Platform further highlight the industry’s geographic diversity. Top country hubs include the United States, United Kingdom, India, Australia, and Canada, demonstrating global market diversity.

Prominent city hubs such as London, New York City, Sydney, Mumbai, and Singapore emphasize strong regional centers of activity. These provide a comprehensive view of the industry’s development and geographic strengths.

A Snapshot of the Global Wealth Management Industry

The wealth management industry grew at an annual rate of 13.19% and expanded across various segments. Over 1100 startups are active in the sector, with 410 in the early stages of development. It emphasizes a strong pipeline of innovation and emerging players. Mergers and acquisitions drive market consolidation, with over 950 recorded deals highlighting dynamic industry restructuring.

Patent activity underscores the sector’s innovative capacity, with more than 40 patents filed by at least five applicants, achieving a yearly growth rate of 5.7%. The USA leads as the top patent issuer, contributing over 20 patents, followed by China with more than 10. It reinforces their roles as hubs of technological advancements in wealth management. This illustrates a vibrant industry marked by growth, innovation, and strategic activity.

Explore the Funding Landscape of the Wealth Management Industry

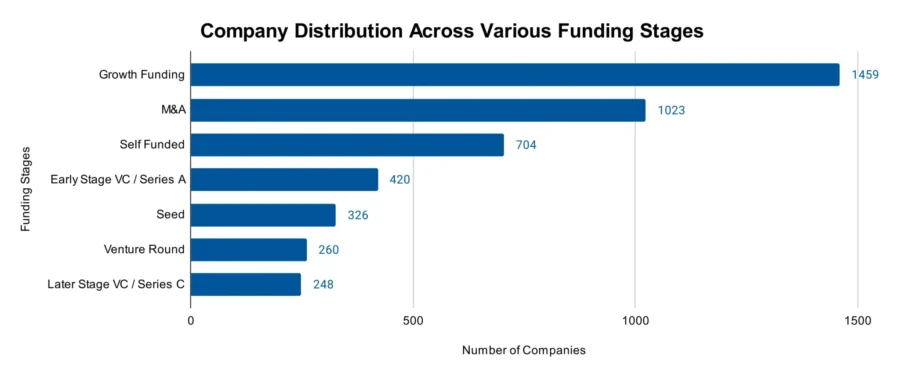

The wealth management industry shows strong investment activity, appealing to investors and businesses. The average investment per funding round is USD 76.4 million and reflects financial backing and confidence in the sector. Over 3000 investors have participated, closing more than 3,900 funding rounds. This demonstrates the industry’s ability to attract substantial capital.

More than 1300 companies have benefited from these investments, which highlights the distribution of financial resources across various players. This shows a vibrant investment landscape in wealth management that promotes growth and innovation throughout the sector.

Who is Investing in Wealth Management Solutions?

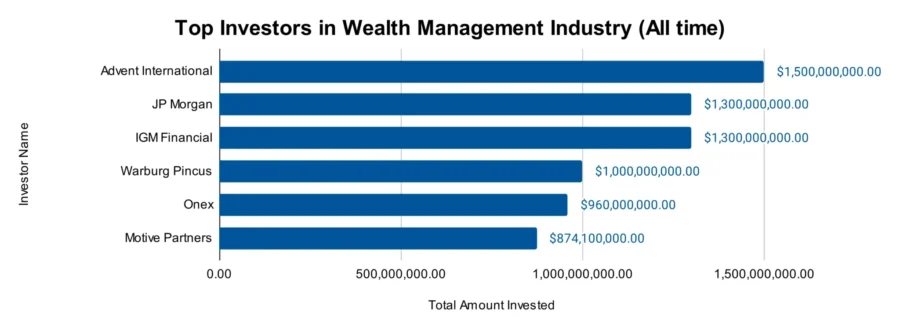

The top investors in the wealth management industry have contributed over USD 5 billion, driving sector growth.

- Advent International allocated USD 1.5 billion to 2 companies, including Svatantra Microfin, which received USD 230 million – the largest private equity investment in India’s microfinance sector.

- JP Morgan diversified investments across 7 companies, totaling USD 1.3 billion.

- IGM Financial channeled USD 1.3 billion into 2 companies, including strategic stakes in Wealthsimple.

- Warburg Pincus supported 4 companies with a total of USD 1 billion. It has invested in firms like CityMD and Summit Medical Group, enhancing healthcare and financial services capabilities

- Onex invested USD 960 million in 2 companies, including Ryan LLC, a global tax services provider valued at USD 2.5 billion.

- Motive Partners deployed USD 874.1 million across 6 companies, focusing on technology-enabled financial services.

Access Top Wealth Management Innovations & Trends with the Discovery Platform

The wealth management industry is transforming rapidly, driven by emerging trends. These trends highlight innovation and evolving workforce dynamics.

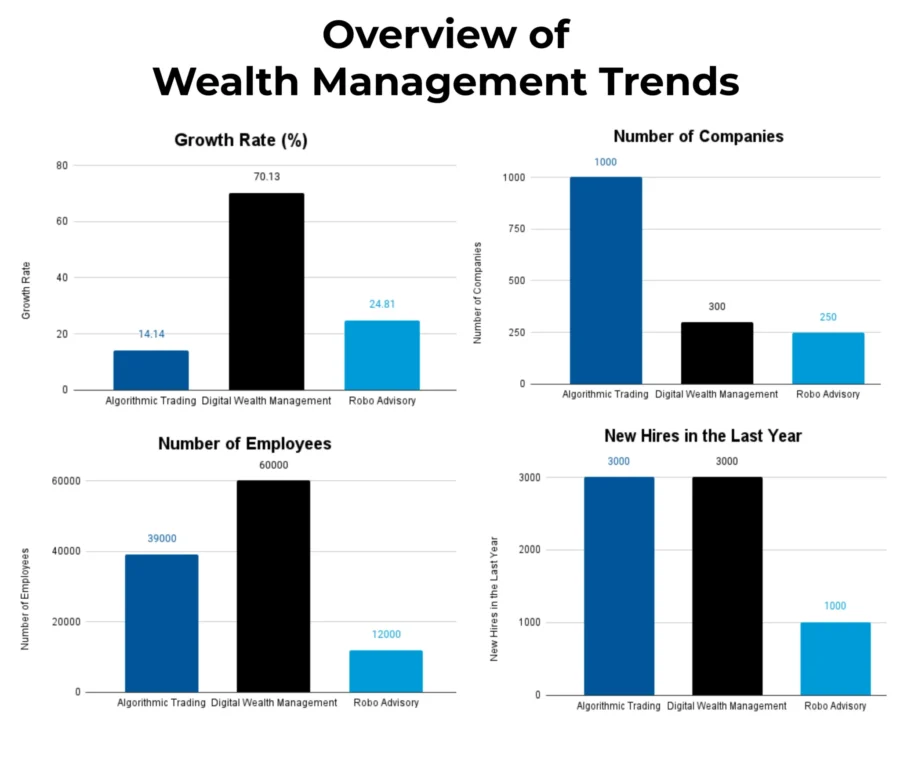

- Algorithmic Trading: Over 1000 companies operate in this domain and employ more than 39 000 individuals. Last year, the workforce grew by 3000, with a 14.14% annual growth rate. Algorithmic trading uses data analytics and machine learning to optimize investment strategies and is becoming a cornerstone of modern financial services.

- Digital Wealth Management: This domain includes 300 companies and more than 60 000 employees, which reflects significant growth potential. It added 3000 new employees last year, with a 70.13% annual growth rate. Digital wealth management integrates platforms to enhance accessibility and personalized financial planning for clients.

- Robo Advisory: Represented by 250 companies, this sector employs 12 000+ individuals, including 1000 added last year. With a 24.81% annual growth rate, robo-advisory services use automated platforms to provide cost-effective, data-driven investment advice, appealing to a broader client base.

5 Top Examples from 1100+ Innovative Wealth Management Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Figg offers AI-driven Wealth Management

Swiss startup Figg develops an AI-driven wealth management platform that consolidates all financial and physical assets into a single application. It allows connecting various assets, including bank accounts, brokerage holdings, properties, vehicles, and collectibles to provide a comprehensive view of the portfolio.

The platform features AI-powered identification for physical assets to offer instant valuations through a camera-based interface. It delivers insights with AI-driven sentiment analysis for both portfolios and watchlists.

Figg employs AES encryption for all connections, data-at-rest encryption, and private cloud infrastructure to ensure data security. The startup gives users control over their finances by integrating diverse assets and delivering personalized financial insights within a secure environment.

Insaaph Capital provides an On-chain Split-crypto Index

UK-based startup Insaaph Capital builds an investment platform using web3 technology to tokenize various asset classes, including cryptocurrencies, across multiple regions. Its product, CONSILIENCE 10|10, is a tokenized index combining the top 10 crypto and top 10 DeFi assets to offer holders diversified, passive exposure weighted by market capitalization.

The platform operates on the Polygon Network and ensures low transaction costs, fast processing times, and transparency through smart contracts. Insaaph Capital integrates asset management, investment banking, and payments into a single application for investors and broadens access to wealth creation opportunities.

Kredit delivers a Credit Robo Advisor

US-based startup Kredit offers a credit-building platform using automation and data-driven insights to improve credit fitness. Its robo-advisor, Kaye, analyzes individual credit data to provide personalized guidance and simplify credit improvement complexities.

The startup’s platform integrates various credit-building tools into a unified dashboard to deliver tailored advice on optimal actions and timing. Kredit democratizes financial inclusion by enabling equitable access to capital for individuals across all socioeconomic backgrounds.

Linconomy specializes in Digital Wealth Management

Danish startup Linconomy offers a wealth management platform that aggregates and reports clients’ diverse assets, including real estate, investments, and pensions. This system provides high-level overviews and detailed analyses that enable financial advisors and clients to monitor and manage portfolios. Its key features include advanced investment performance analysis, scenario simulation tools, risk assessment, and sustainability evaluations, for informed financial decision-making.

The platform supports secure, encrypted client communication and generates tailored, automated reports to ensure accurate and timely updates. Linconomy modernizes wealth management and provides a transparent and holistic view of clients’ financial health.

Flanks develops an Open Wealth Platform

Spanish startup Flanks provides LUME, a modular wealth management solution that automates the aggregation of clients’ financial and non-financial assets into a unified platform. It uses diverse methods, such as data feeds, eBanking access, and open APIs to gather global asset data.

The platform standardizes, validates, reconciles, and enriches this data with market information to ensure consistency and quality. The users access consolidated reports through an online portal, API, or downloadable formats, with customizable features like white-label branding and modular report structures.

Flanks eliminates manual consolidation efforts, which allows wealth managers to focus on strategic growth and deliver comprehensive, real-time insights into clients’ portfolios. Recently, Flanks raised USD 8 million in Series A funding to expand its offerings internationally and further develop its product pipeline.

Gain Comprehensive Insights into Wealth Management Trends, Startups, or Technologies

The wealth management industry is set for growth in 2025, driven by digital transformation and client-centric innovations. Trends like algorithmic trading, digital wealth platforms, and robo-advisory will reshape client engagement and investment strategies. With technological advancements and increasing global adoption, the industry will deliver personalized, scalable, and efficient financial solutions. Get in touch to explore all 1100+ startups and scaleups, as well as all industry trends impacting wealth management companies.