The 2024 Zero Waste Report provides an overview of the sector’s dynamic landscape, focusing on trends, innovations, and market activity. The report explores the industry’s vital role in sustainability efforts, focusing on waste reduction and circular economy practices. It also highlights the roles of key participants, investment trends, and technological developments advancing the sector.

This report was last updated in July 2024.

This zero waste industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Zero Waste Report 2024

- Executive Summary

- Introduction to the Zero Waste Report 2024

- What data is used in this Zero Waste Report?

- Snapshot of the Global Zero Waste Industry

- Funding Landscape in the Zero Waste Industry

- Who is Investing in Zero Waste?

- Emerging Trends in the Zero Waste Industry

- 5 Zero Waste Startups Impacting the Industry

Executive Summary: Zero Waste Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 900+ zero waste startups developing innovative solutions to present five examples from emerging zero waste industry trends.

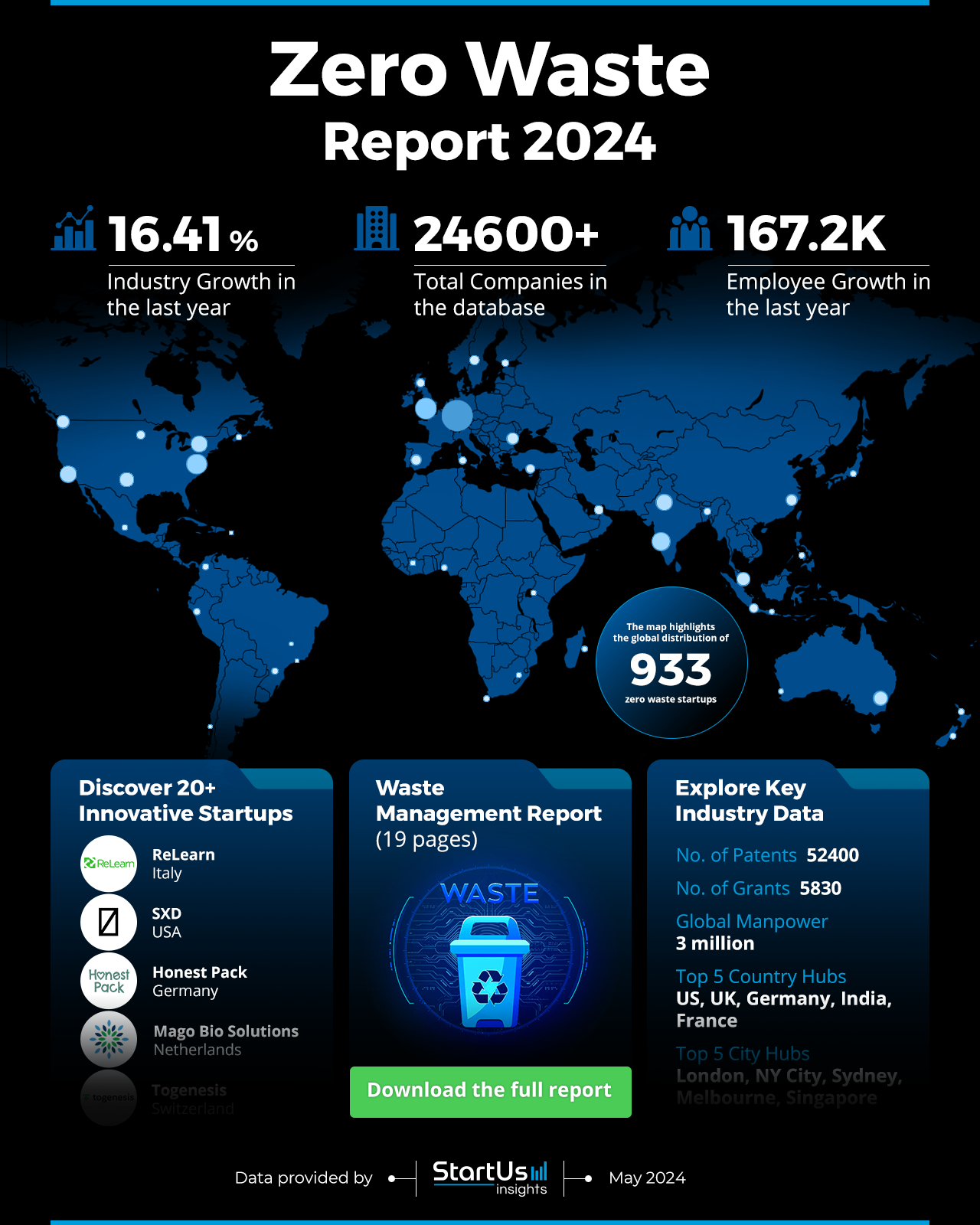

- Industry Growth Overview: The zero waste industry is growing with an annual growth rate of 16.41%, with over 24600 companies listed.

- Manpower & Employment Growth: The industry employs 3 million workers globally, with an employee growth of 167000 in the last year.

- Patents & Grants: The sector has a portfolio of over 52400 patents and also secured 5830 grants, emphasizing innovation capabilities, research, and development efforts.

- Global Footprint: Innovation hubs include countries such as the US, UK, Germany, India, and France. City hubs are London, New York City, Sydney, Melbourne, and Singapore, indicating concentrations of activity.

- Investment Landscape: The average investment value in the industry is USD 44.6 million per round. It has attracted more than 3500 investors and over 10800 funding rounds have been closed, benefiting more than 4300 companies.

- Top Investors: Investors like the European Investment Bank, Global Emerging Markets, Temasek Holdings, and more have collectively invested more than USD 8 billion

- Startup Ecosystem: Highlights include startups like ReLearn (Zero-waste Monitoring Tool), SXD (Zero-waste Design), Honest Pack (Zero-waste Packaging), Mago Bio Solutions (eComposting), and Togenesis (Zero Waste Platform).

- Recommendations for Stakeholders: Investors should focus on emerging trends and partner with impact-driven organizations. Entrepreneurs can leverage AI and data-driven insights to create innovative solutions targeting specific niches. Governments should also incentivize zero waste practices and continue to support research and development. Collaboration and innovation are key to implementing a zero-waste future.

Explore the Data-driven Zero Waste Report for 2024

The zero waste report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap presents key data points from our database, illustrating the landscape of the startup and innovation ecosystem. With 933 startups among over 24600 companies, the industry has seen a growth rate of 16.41% over the past year. This growth is supported by the achievements of 52400 patents and 5830 grants awarded.

The global manpower is at 3 million, with an employee growth of 167200 in the last year. Innovation hubs include countries such as the US, UK, Germany, India, and France, with city hubs being London, New York City, Sydney, Melbourne, and Singapore. This highlights the industry’s developments and concentrations of activity.

What data is used to create this zero waste report?

Based on the data provided by our Discovery Platform, we observe that the zero waste industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry has received news coverage with more than 2700 publications in the last year.

- Funding Rounds: Our database contains data on over 10800 funding rounds, indicating financial activity.

- Manpower: The industry employs over 3 million workers, with an addition of more than 167000 new employees in the past year.

- Patents: It has a portfolio of over 52000 patents, indicating its innovation capabilities.

- Grants: The industry has secured 5830 grants, showing its research and development efforts.

- Yearly Global Search Growth: The yearly global search growth for the zero waste industry is at 35.02%, showing interest and engagement.

A Snapshot of the Global Zero Waste Industry

The zero waste industry is growing, with notable growth and investment activity. The industry employs 3 million workers, with an employee growth of 167000 in the last year. This workforce supports over 24600 companies, indicating the sector’s footprint.

Explore the Funding Landscape of the Zero Waste Industry

Investment in the zero waste industry is steady, with an average investment value of USD 44.6 million per round. The industry has attracted more than 3500 investors, indicating financial backing and confidence in its future. Over 10800 funding rounds have been closed, benefiting more than 4300 companies. This level of investment shows the industry’s potential and the interest from investors to support sustainable and innovative solutions.

Who is Investing in Zero Waste?

The combined investment value by investors in the zero waste industry is over USD 8 billion, indicating a commitment to supporting sustainable and clean practices across industries. Here are the investors and their respective investments:

- The European Investment Bank has invested USD 1.5 billion in 10 companies, showing its support for environmental sustainability in Europe.

- Global Emerging Markets has invested USD 693.8 million in 5 companies, highlighting its focus on growth potential in the zero waste sector.

- Temasek Holdings has invested USD 670.8 million in 6 companies, indicating its strategic investments in sustainable initiatives.

- GIC has invested USD 635.4 million in 5 companies, demonstrating its dedication to long-term sustainable growth.

- Goldman Sachs has invested USD 616 million in 3 companies, indicating its confidence in the sector’s potential.

- Stellantis has invested USD 570.3 million in 3 companies, supporting sustainable transportation and waste management technologies.

- Berkshire Hathaway has invested USD 549.1 million in 2 companies, showing its interest in sustainable investment opportunities.

- Bain Capital has invested USD 519 million in 2 companies, fostering sustainable business models.

Access Top Zero Waste Innovations & Industry Trends with the Discovery Platform

The trends in the zero waste industry are creating a sustainable future. Here are firmographic insights on a few of the key trends:

- Circular Economy practices are central to the zero waste industry, with 20098 companies identified. Companies in this field design products and systems to efficiently and endlessly reuse raw materials for various manufacturing and production processes. This sector employs 2.2 million people, with 125300 new employees added last year. The trend’s annual growth rate is 7.5%, reflecting the rising global emphasis on sustainability.

- Waste Valorization, a growing trend within the zero waste industry, involves converting waste materials into valuable products. This trend includes 102 companies, employing 2100 people, with over 200 new employees added last year. The annual trend growth rate is 50.75%, showing the massive interest and investment in this area.

- The Food Waste Reduction trend tackles the issue of food waste in the industry. With 237 companies identified, this sector employs 19000 people and has seen an increase of 1400 new employees last year. The annual trend growth rate is 26.91%, indicating a strong focus on reducing food waste across supply chains.

5 Top Examples from 900+ Innovative Zero Waste Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

ReLearn provides Zero-waste Monitoring Tools

Italian startup ReLearn creates solutions that monitor waste production through the use of AI and gamification. One of its products, NANDO.Sensor gathers waste data for sustainability reports and enhances waste management operations. Its NANDO.App then monitors container fill levels, improves truck routes, and lowers disposal costs. NANDO.Eye, a waste scanner, identifies objects and guides the correct sorting location. The platform caters to a variety of sectors, including offices and industrial waste, and encourages practices to eliminate waste. In addition, ReLearn offers precise CSRD and ESG reporting to enable companies to reach their sustainability objectives.

SXD creates Zero-waste Design

US-based startup SXD creates zero fabric waste patterns using advanced design technology. The SXD AI software combines sketch and fabric details to generate efficient patterns, thereby reducing textile waste. It automatically adjusts patterns to fit different sizes and fabric widths, ensuring balance and striving for minimal waste. SXD AI facilitates integration from design to production with PDF and DXF exports. SXD manages intricate patterns without compromising the creative vision and promotes radical sustainability in the fashion industry.

Honest Pack offers Zero-waste Packaging

German startup Honest Pack provides sustainable packaging solutions for the catering industry. Its product line includes a reusable system for pizzerias, featuring a scratch-resistant base structure with precise cutting guides. The startup utilizes biopolymer, polypropylene, and coffee pods in its products. Honest Pack’s packaging products, which are biodegradable and compostable, reduce waste and minimize environmental impact.

Mago Bio Solutions enables eComposting

Dutch startup Mago Bio Solutions develops eComposter to convert organic waste into valuable resources to promote a zero-waste future. The eComposter facilitates a natural process in which bacteria turn residual flows into compost and fertilization liquid. The heat produced during the composting process is used to heat water, providing a source of clean, renewable energy that is utilized for preheating hot water supplies or heating systems. The resulting compost and fertilizing liquid are also applied directly to nearby greenery. Mago Bio Solutions serves various sectors, including restaurants, hotels, holiday parks, supermarkets, and agricultural businesses.

Togenesis develops a Zero Waste Platform

Swiss startup Togenesis develops a digital platform that aids in the reclamation of packaging and end-of-life products to achieve zero waste. This platform closes a loop between all parties involved. The startup’s app enables citizens to schedule the pickup of household waste from their residences. It also offers statistics on the amount of CO2 emissions prevented and the environmental impact. Both companies and waste managers utilize this platform to work towards their sustainability objectives.

Looking for Comprehensive Insights into Zero Waste Trends, Startups, or Technologies?

The 2024 Zero Waste Report highlights the sector’s dynamic growth and commitment to realizing sustainability goals. Emerging trends such as the circular economy, waste valorization, food waste reduction, and more drive future innovations and market expansion. Get in touch to explore all 900+ startups and scaleups, as well as all zero waste trends impacting companies across industries.